These services are not free though and they will take a cut, but the convenience of them and getting prompt payments are worth seriously considering.The accounts receivable turnover measures the number of times a business is able to convert its outstanding accounts receivables to cash within a certain period. If you are accepting cheques or wire transfers, services like Plooto or provides ways to automate accounts receivable.įor payments through a credit card, companies like PayPal, Stripe, or Square are all useful for accepting credit card payments. There are multiple digital services that can be used to receive payments. Making payments convenient means that your customers are more likely to make those payments on time. Being present during customer service issues is helpful to make sure they know you care about their concerns. For example, you could give them a follow-up email or call to check up with them. There are many ways to improve the relationship you have with your customers. If your customers are happy with your quality of service the chances of them paying will go up.

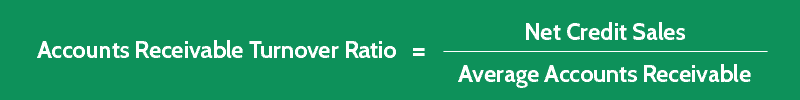

It is important to build positive relationships with your customers. Customers are more likely to pay a smaller amount, and billing often means that the customer would have a lower chance of forgetting about what they owe you. Sending bills often means the bills will be for lower amounts. This means, don’t wait until customers owe a lot to send a bill. Combined with also accurate and detailed bills means your customers will be more willing to pay the bill. Invoice promptly and accuratelyīilling your customers promptly is important. Organization of your documents can also help you easily access all the information needed to provide accurate bills. It will also help when it comes to figuring out what you are owed. Keeping your documents, accounts and bills organized is time-consuming but it is worthwhile. Tips for improving your Accounts Receivable Turnover Be organized For example, with a net credit sales of $2,000,000 and an average accounts receivable of $100,000 the accounts receivable turnover is (2,000,000/100,000) = 20. To calculate the accounts receivable turnover use the following formula: Net credit sales / Average accounts receivable. For example, with a beginning accounts receivable being $150,000 and an ending accounts receivable of $50,000, the average accounts receivable is ($150,000 + $50,000) / 2 = $200,000 / 2 = $100,000. This is calculated using the following formula: (beginning accounts receivable + ending accounts receivable) / 2. This is calculated by calculating the returns and discounts on credit sales and subtracting that and other reductions from the gross credit sales.įirst, you will need to calculate the average accounts receivable. The net credit sales is the amount of money your company has received from credit over a period of time. The time period for both sets of data needs to be the same for this calculation. The accounts receivable turnover ratio is calculated by dividing net credit sales by the average accounts receivable. How do you calculate your Accounts Receivable Turnover? The following tips will help improve your accounts receivable turnover ratio. Or it could mean that your collections are not working in the most efficient manner. Also, if you have a low ratio, then that could mean your customers are not financially reliable. This could building expenses, taxes, or emergency funds. Also, increasing your accounts receivable turnover means you have more cash on hand for all of your expenses. Why should you care about your accounts receivable turnover?įor this metric, the higher your ratio, the more efficient your company is at collecting your accounts receivable over the year. This ratio is a valuable metric used to measure how efficient your business is at offering credit to customers and then receiving what you are owed. The accounts receivable turnover ratio is calculated by dividing the net credit sales by the average accounts receivable. It follows then that accounts receivable turnover is a ratio of how often your business collects the money that is owed to you, your accounts receivable, during a year. Accounts receivable is what your company is owed from your customers.

0 kommentar(er)

0 kommentar(er)